Federal estimated tax payments 2021

How do I make federal quarterly estimated payments. The IRS provides various methods for making 2022 quarterly estimated tax payments.

W 4 Form What It Is How To Fill It Out Nerdwallet W4 Tax Form Tax Forms Changing Jobs

The estimated tax payments are due on a quarterly basis.

. You can make estimated tax payments using any of these methods. Enter the federal estimated income tax payments made in 2021. The first line of the address should be Internal Revenue Service Center.

Mailing Addresses for IRS Form 1040-ES If You Live In. You expect to owe at least 1000 in tax for 2021 after subtracting your withholding and refundable credits. If the amount of income tax withheld from your income is not enough then.

If you e-file your 2021 tax return you can use EFW to make up to four 4 2022 estimated tax payments. Ad Access IRS Tax Forms. Federal Estimated Tax Payments Made in 2021.

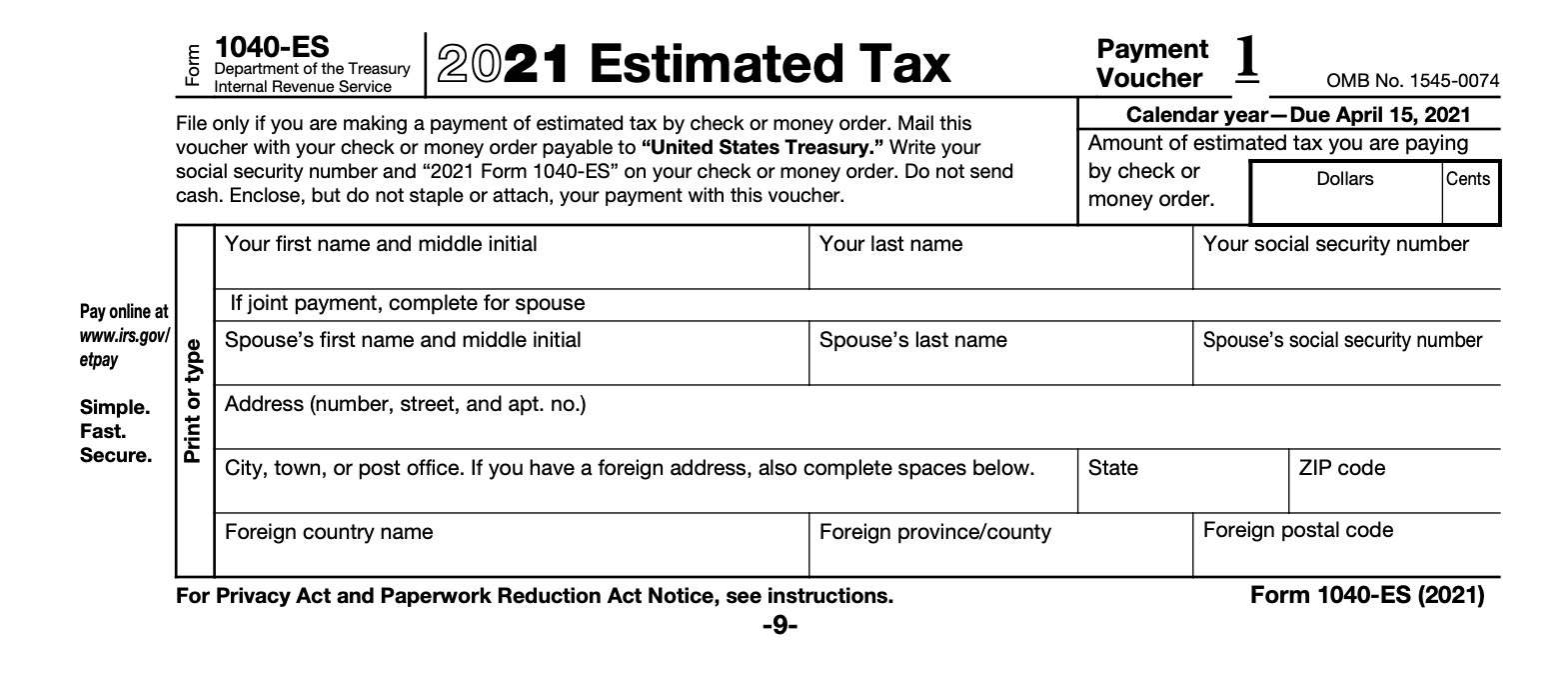

You may credit an overpayment. The partners may need to pay estimated tax payments using Form 1040-ES Estimated Tax for Individuals. It is mainly intended for residents of the US.

Select a Premium Plan Get Unlimited Access to US Legal Forms. See What Credits and Deductions Apply to You. Estimated Tax Payments - Electronic Funds Withdrawal.

You may include the credit applied from your 2020 federal income. You expect your withholding and refundable credits to be less than the. As a partner you can pay the estimated tax by.

Make joint estimated tax payments. This is a free option. Apply your 2021 refund to your 2022 estimated tax.

Estimate Your Taxes And Refunds Easily With This Free Tax Calculator From AARP. Ad Use Our Free Powerful Software to Estimate Your Taxes. However the quarters arent equal the second quarter is.

Estimated tax payments is a method use to pay tax on income that is not subject to tax withholding. 425 57 votes The deadline for making a payment for the fourth quarter of 2021 is Tuesday January 18 2022. Enter the federal estimated income tax payments made in 2021.

425 57 votes The deadline for making a payment for the fourth quarter of. And is based on the tax brackets of 2021 and. Income taxes are pay-as-you-go.

You can pay all of your estimated tax by April. Fill Edit Sign Forms. Estimated taxes are paid quarterly usually on the 15th day of April June September and January of the following year.

Payment Amount Due date. And those dates are roughly the same each year the 15th of April June. Complete Edit or Print Tax Forms Instantly.

Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. In most cases you must pay estimated tax for 2021 if both of the following apply. Federal Estimated Tax Payments Made in 2021.

Report on line 31 all federal tax withheld estimated tax payments and federal taxes paid in 2021. You expect to owe at least 1000 in tax for 2021 after subtracting your withholding and refundable credits. Enter Your Tax Information.

One notable exception is if the 15th falls on a. Use this secure service to pay your taxes for Form 1040 series estimated taxes or other associated forms directly from your checking or savings. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return.

You may include the credit applied from your 2020 federal income. Estimated Tax Due Dates for Tax Year 2022. Mail a check or money order with Form.

When to Pay Estimated Taxes. Taxpayers whose adjusted gross income is 150000 or more must make a payment equal to 110 of the previous years taxes or 90 of the tax for the current year. You should pay taxes on the earnings from each quarter after the quarter has ended.

Crediting an overpayment on your. These individuals can take credit only for the estimated tax payments that they made.

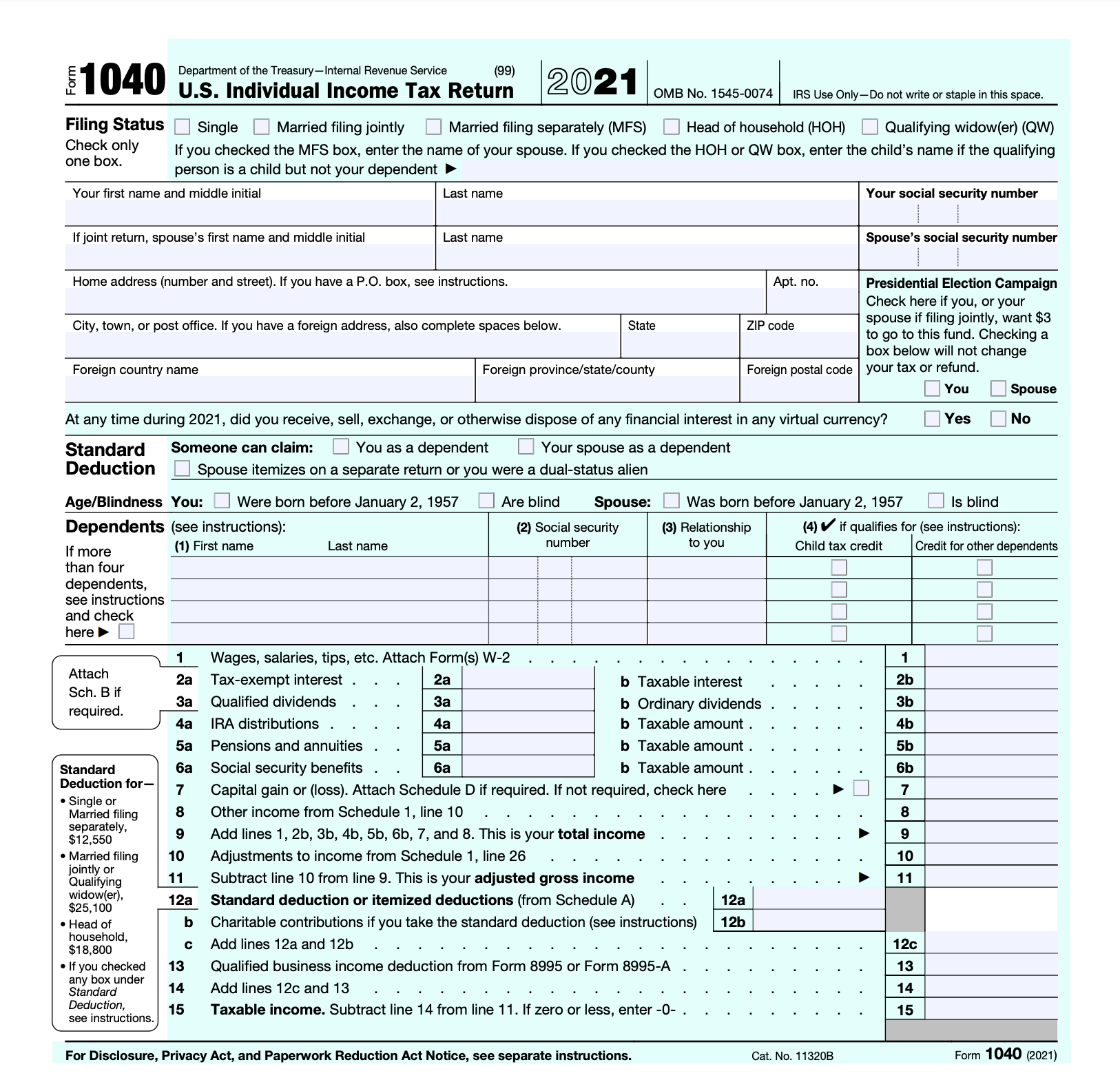

Irs Form 1040 Individual Income Tax Return 2022 Nerdwallet

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Minnesota W4 Form 2021 W4 Tax Form Tax Forms Filing Taxes

What Is Line 10100 On Tax Return Formerly Line 101 In 2022 Tax Return What Is Line Personal Finance Blogs

Estimated Income Tax Payments For 2022 And 2023 Pay Online

Centuryaccounting Posted To Instagram Do You Know The One Thing We Insist Every Taxpayer Should Do E File Their Ret Tax Refund Federal Income Tax Income Tax

What Is Irs Form 1040 Es Guide To Estimated Income Tax Bench Accounting

:max_bytes(150000):strip_icc()/ScreenShot2021-02-12at8.44.24AM-0ce056f964b044c8a9841ac00c3fac5d.png)

Form 941 Employer S Quarterly Federal Tax Return Definition

When Is The Form 941 Due For 2021 Due Date Irs Forms Form

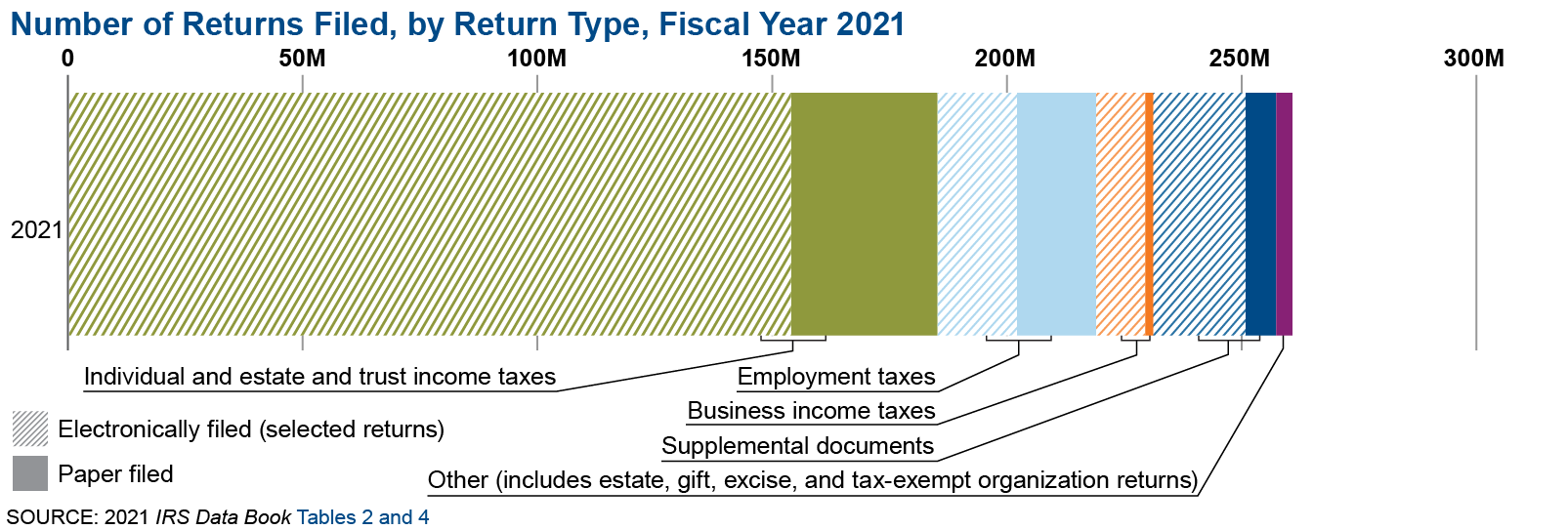

Returns Filed Taxes Collected And Refunds Issued Internal Revenue Service

What Happens If You Miss A Quarterly Estimated Tax Payment

1040 2020 Internal Revenue Service Internal Revenue Service Worksheets Instruction

Fillable Form W 2 Or Wage And Tax Statement Edit Sign Download In Pdf Pdfrun Tax Forms Internal Revenue Service Fillable Forms

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Federal Income Tax Deadlines In 2022 Tax Deadline Income Tax Deadline Federal Income Tax

Federal Income Tax Deadlines In 2022 Tax Deadline Income Tax Deadline Income Tax

/9465-700bb91065234917b8d2866f2306afe9.jpg)

Form 9465 Installment Agreement Request Definition